Πως δουλεύει?

Search

Need help?

Speak to a Customer Relations Consultant for Online Sellers. An expert will respond shortly.

amavat Sp. z o.o.

ul. Zwycięska 45

53-033 Wrocław

53-033 Wrocław

Welcome to the amavat® Customer Portal.

We understand that information, and accurate information is key! Let us provide you with the necessary dashboards and reports to keep you fully informed.

amavat® constantly invest time striving to improve efficiency through automation for our clients, so that it is scalable and a proficient service. Our IT team has developed a solution that offers this automated approach to managing tax determination, calculation and compliance around Europe.

When we create an automated product we ensure it can be integrated and designed to work together – providing a wholesome experience. Our Customer Portal can be assessed by multiple users and across multiple devices – improving performance and productivity. This linked to our VAT compliance experts, we are available when you need us.

On this page we give you a full and complete overview of your data i.e. business address, but you will also see a list of countries for fulfilment i.e. where you are selling your goods/products.

Useful feature is that you will see when you have to report to these countries, be it monthly/quarterly.

Having your ‘Sales and Refund analysis’ on one screen giving you an excellent dashboard showing you the following important information, so that your fully up-to-date.

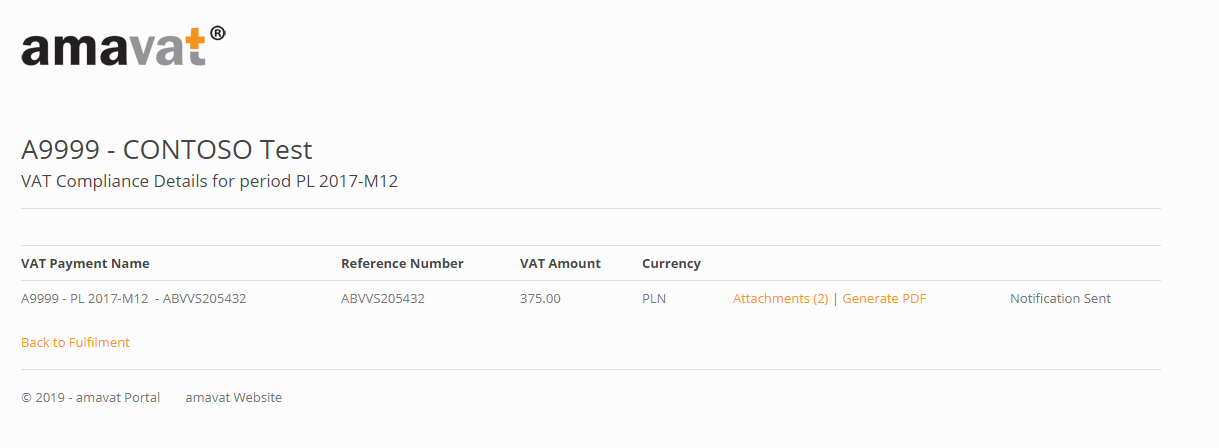

Here you will see how much you have to pay to the Tax Authority (you can also find attachments, if uploaded and can even generate PDF statement).

The log-in data below should be entered in the entry screen. Special attention should be paid to the use of ‘upper’ and ‘lower’ case letter.

For all language users:

Username: test@amavat-europe.com

Password: Amavat2018!

Speak to a Customer Relations Consultant for Online Sellers. An expert will respond shortly.